This story is a reprint from Kyowa Kirin Annual Report 2020.

Targeting sustained, long-term increases in ROE and dividends by boosting growth, innovation and profitability

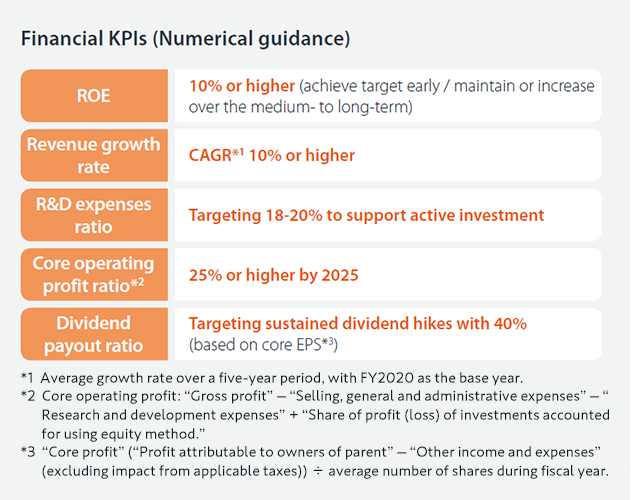

Numerical guidance in the FY2021-2025 Medium Term Business Plan

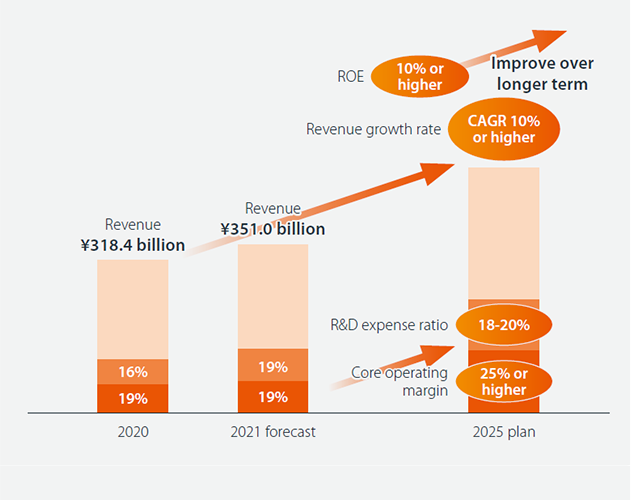

In the FY2021-2025 Medium Term Business Plan, we are targeting sustainable growth beyond FY2025 and increased corporate value over the medium- to long-term. To measure progress, we are using return on equity (ROE) as a key performance indicator (KPI). Our aim is to achieve ROE of 10% or higher as early as possible (vs. ROE of 7% in 2020) so that ROE consistently exceeds the expected cost of capital. We also aim to increase ROE over the longer term.

To achieve our ROE objectives, we need to continuously increase the Group’s growth potential, capability to innovate and profitability, and we have selected three KPIs to measure our progress in those areas: revenue growth rate, R&D expenses ratio and core operating profit ratio.

Executive Officer,

Director, Finance Department

First, let’s look at the revenue growth rate (growth potential benchmark). During the five years of the Medium Term Business Plan, we are targeting average annual top-line growth of 10% or higher. We aim to do that by implementing further steps to increase sales and maximize the value of existing global strategic products and by steadily rolling out the next-generation strategic products. Second, the R&D expenses ratio (capability to innovate benchmark). Our goal is to expand the drug pipeline to accelerate and drive the Group’s growth beyond FY2025 by consistently and actively investing in research and development, aiming for an R&D expenses ratio target of 18-20% (vs. 16% in 2020). At the same time, we will work to improve profitability by reducing the selling, general and administrative expenses ratio through tighter cost control to achieve our third KPI, a core operating profit ratio (profitability benchmark) of 25% or higher (vs. 19% in 2020) by FY2025, the final year of the plan.

By implementing measures to achieve those three KPIs, we are targeting growth in core operating profit and core EPS that outpaces revenue growth in order to improve ROE over the medium- to long-term and support sustained increases in the dividend. Ultimately, our objective is to establish a stable earnings structure and generate continued growth as a Global Specialty Pharmaceutical Company (GSP).

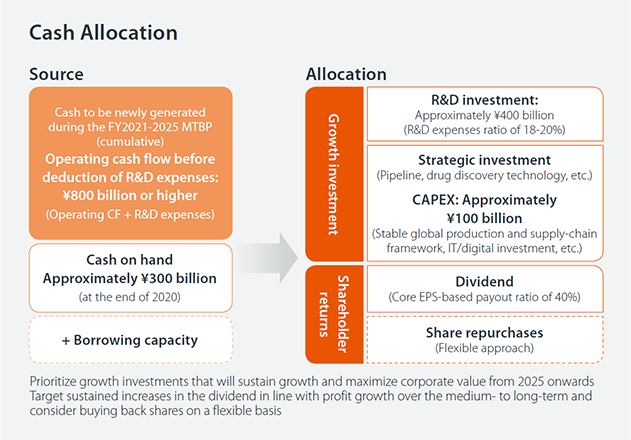

Cash allocation and investments in growth

In our five-year cash allocation plans in the FY2021-2025 Medium Term Business Plan, we assume the source of funds will be new operating cash flow of \800 billion or higher (before deduction of R&D expenses) generated during the plan’s five years, as well as cash on hand of roughly \300 billion as of end-FY2020. In principle, our policy on cash allocation is to maintain a net cash position, while also ensuring sufficient financial flexibility by securing borrowing capacity and responsive fund-raising methods (commercial paper, commitment lines), in addition to cash on hand, to ensure access to sufficient funds for large-scale strategic investments if the need arises.

Our top priority for cash allocation is R&D, Strategic, and Capital investments to sustain growth beyond FY2025 and maximize corporate value.Over the plan’s five years, we aim to invest roughly \400 billion in R&D and spend approximately \100 billion on capital investment, while taking a flexible and active stance on strategic investments.

R&D investment

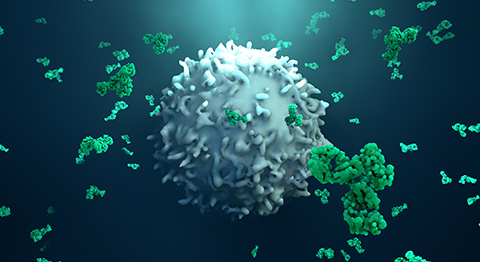

The Kyowa Kirin Group has world-class R&D and drug discovery capabilities in the field of biopharmaceuticals. To further strengthen the Group’s ability to innovate and sustain growth beyond 2025, we aim to continue investing heavily in R&D during the FY2021-2025 Medium Term Business Plan, based on an R&D expenses ratio of 18-20% (R&D investment as a percentage of revenue). In R&D activities, we will channel resources into the development of next-generation global strategic products such as KHK4083, KW-6356 and ME-401 to maximize the value of our pipeline.

We also plan to invest heavily in areas that support innovation over the long term, such as multi-modality technology platforms that can create groundbreaking new treatments, aiming to consistently create new products that bring life-changing value to patients.

Strategic investment

In addition to internal R&D efforts, we will actively utilize external resources through strategic partnerships (in-licensing, tie-ups, etc.) and M&A to introduce drug discovery technologies and new compounds for our pipeline.

And we are aiming to faster our sustained growth by expanding our global pipeline over the medium- to long-term, generating synergies with existing global strategic products, and increasing opportunities to create Only-one value. The Strategic Investment Review Committee, which is led by CEO Masashi Miyamoto, has been conducted roughly twice a month to actively discuss potential targets for strategic growth investments.

Capital Investment (CAPEX)

We will invest heavily to create a more competitive business structure to help us maximize the value of global strategic products. In particular, we will focus on establishing a robust quality assurance and production system that can reliably supply safe, high-quality pharmaceuticals to patients worldwide. We are also aware that we need to reinforce the Group’s functions as it expands and develops globally. Specifically, we aim to rapidly establish a global business foundation that supports Kyowa Kirin’s sustained growth as a GSP, which will mean investments to reinforce global governance and risk management systems and to build a platform that allows us to strategically utilize IT and digital tools.

When evaluating the profitability of those potential investments or development projects, we use two quantitative standards: net present value (NPV) and expected present value (EPV). Both standards are based on the hurdle rate (by region), which reflects the expected cost of capital (WACC) for investors. In investment decisions, we focus on whether the investment will contribute to an increase in corporate value over the medium- to long-term by generating returns in excess of the cost of capital.

Shareholder returns

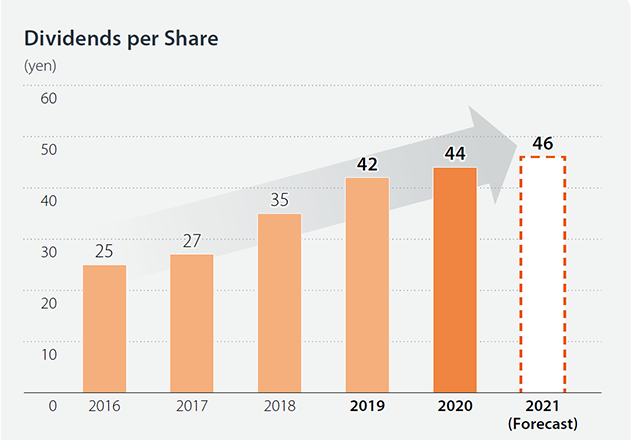

In the FY2021-2025 Medium Term Business Plan, we are targeting a consolidated dividend payout ratio of 40% based on core EPS, aiming to steadily increase returns for investors by raising the dividend in line with profit growth over the medium- to long-term. Based on that policy, we plan to raise the dividend to \46.00 per share for FY2021, a hike of \2.00 from FY2020 and the fifth consecutive year of increases. We will also flexibly consider buying back shares, taking into account the share price and other factors.

To generate sustained growth and maximize corporate value as a Japanbased GSP, we will enhance the Group’s growth potential, capability to innovate and profitability in order to improve ROE over the medium- to long-term and support sustained increases in the dividend.